UAE VAT ACCOUNTING TIPS

VAT tips is a bullet

point section giving you lots of hints on how to effectively maintain your

records as well as some general points

Generalities:

VAT

will be implemented on 01-01-2018, it is advisable for organizations not to bet

on an implementation delay.

The

GCC countries implementing the Vat simultaneously are KSA, UAE, Qatar, Bahrain,

Kuwait & Oman. Since it seems that only the UAE and KSA will be the early implementers

of the VAT as at 01-01-2018.

VAT

rate is 5% for the time being as there is no guarantee that there

would be a rate increase or a different kind of tax later on.

It

is mandatory for businesses to register for VAT if their taxable supplies

(Turnover) and/ or imports exceed the mandatory registration threshold of AED

375,000. Furthermore, a business may choose to register for VAT voluntarily if

their supplies and imports are less than the mandatory registration threshold,

but exceed the voluntary registration threshold of AED 187,500. Similarly, a

business may register voluntarily if their expenses exceed the voluntary

registration threshold. This latter opportunity to register voluntarily is

designed to enable start-up businesses with no turnover to register for VAT.

In

the UAE, the tax legislation is being implemented by the Federal Tax Authority

(FTA) www.tax.gov.ae.

FREE

ZONES: articles 50,51 and 52 of the Decree-law 8 state that Designated

Zones are to be considered as out of state, this may apply to FENCED free

zones (example JAFZA), OPEN free zones may be treated as local companies

awaiting clarifications from the soon to be released executive regulation.

Export is zero rated VAT

while Import is taxable.

Reverse

charge mechanism should be applied to any kind of import of services from a

non-GCC country (that logically do not pass through the customs for clearance).

Reverse charge rule:

Since it is difficult to enforce the law against the import of services or

other intangibles, as it does not pass through the country’s customs. Input VAT

on imported services is self-assessed by the recipient who can claim it in

reverse (a reverse charge). The reverse charge mechanism moves the

responsibility for the reporting of a VAT transaction from the seller to the

buyer of a good or service.

Example:

Purchase of an antivirus software for AED 1,000/-, since it is an online

transaction, no customs are involved. Accordingly, at the time of filing the

tax returns, the company should declare that it purchased this service and

notifies the authorities that the related VAT is AED 50, but since it is an

input tax on the company, it will not incur any payment for the same.

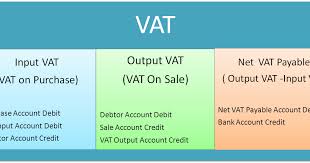

Accounting Entry for VAT :

Debit:

the related expense account: 1,000/- AED

Debit: Input Tax

account for 50/- AED

Credit Supplier

Account for 1,000/- AED

Credit

Output Tax account for 50/- AED

- As

of now, no provision is taken to enable the tourists who purchased goods

while visiting the country to reclaim the tax upon exiting the country as

in Europe.

- Grouping:

a grouping is a process of combining the activities of several entities

into one group. Such a process will enable the group to report its tax as

one entity. We expect a legislation to appear soon outlining the full

process.

- As

of 24/10/2017, it seems they are letting LLC to group with Free Zones if

they fill the required parameters.

- In

the case on an inflicted fine, the company can object the FTA decision

through a specified process within 20 business days from notice date. On

the other hand, FTA will have an additional 20 business days to revert.

Further escalation can be opted for through the Tax Disputes Resolution

Committee.

- Import: if an import is considered

by the customs as being undervalued, they have the authority to charge VAT

according to the fair market value. Usually, all related expense incurred

to receive the taxable item i.e. CIF (Cost Insurance Freight) are to be

included in the import cost and taxed accordingly.

- Always be the devil’s advocate, be

in the VAT inspector shoes:

- While filing for Output tax: this is not the last stage of the filing by any means, VAT inspectors may contact you for further documents justifying your filing and may pop up at any time (within 5 years) asking for proofs that tally to the figures you disclosed and paid your tax accordingly for any given period. It is much advisable to keep a printout of all sales ledgers and proof of export if applicable.

- Be prepared and do not let the inspector feel that

you are disorganized, which will lead to doubting your records in full.

In many instances, the VAT inspection is not carried out randomly, they

may have inspected one of your clients or suppliers and accordingly found

your company. They also may have chosen a specified business activity and

targeted all related companies.

- Reorganize your chart of accounts

to accommodate the VAT:

- Have separate ledgers for the

sales

- Local sales falling under

normal VAT procedure

- Taxable Export Sales (GCC Sales), this ledge may become a twisty issue since some GCC state are not implementing the VAT at 1st of Jan 2018 and accordingly should be treated as non-GCC sales.

- Zero-rated export sales.

- Sales of VAT exempt products

if any.

- Have a separate Master

account for the VAT which can be as per the following chart:

Master Account

|

Description

|

Sub-Master Account

|

Description

|

Controls

|

441

|

VAT Input Tax

|

4410

|

VAT on Purchases

|

Should be equal to 5% of the cost of sales ledge for a

given period

|

4411

|

VAT on Capital Purchases

|

Should be equal to 5% of any new fixed asset acquisition

for a given period

|

||

4412

|

VAT on expenses

|

Should be equal to 5% of the total taxable expenses for a

given period

|

||

442

|

VAT Output tax

|

4420

|

VAT on sales

|

Should be equal to 5% of the total taxable income for a

given period (including taxable export (GCC)

|

4421

|

VAT on advance payments received

|

Advance amounts received /105 x 5 (i.e. a temporary VAT

collection) as if the client is paying with VAT

|

Under each Sub Master

Account, a detailed ledger by name should be created to each Supplier client of

any other Debtor and Creditor. The reason behind that is being able to cross

check in 2 ways:

- Total taxable sales x 5 % should

be equal to the total of Sub-master A/C 4410, the same goes to all

sub-master accounts as indicated above. By using any similar layout, you

will easily cross-check your figures without resorting to complex excel

sheets, you should immediately tackle any discrepancy as it may be a false

voucher entry or something more complicated.

- By having a detailed VAT accounts by name, you can check the VAT levied on/by any specified client/ supplier without having to do any manual calculation, furthermore the simplicity if this procedure will enable the organization to answer any query raised by the authorities on a specified subject without going into multiple cross-checking.

- You will find here-below a

specimen of an entry having VAT:

Sales Entry Specimen

|

|||

Date: 02-01-2018

|

|||

Account

|

Name

|

Debit

|

Credit

|

41110001

|

Client: Company A

|

105,000.00

|

|

44200001

|

VAT on Sales: Company A

|

5,000.00

|

|

70010001

|

Sales under VAT

|

100,000.00

|

|

105,000.00

|

105,000.00

|

The double benefit of

such an entry is that the Sub-Master account of the Sales under VAT (7001)

multiplied by 5% should be equal to the Sub-Master of VAT on Sales (4420);

Furthermore, the company can at any time check the amount of VAT levied on any

given client by logging to the related auxiliary under Sub-Master (4420) as

there is a possibility that the authorities will require the company to

disclose the amount of VAT levied on any given client to cross-check the

supplied figures.

A much complex entry will

be as follows:

Sales

Entry Specimen

|

|||||

Date: 02-01-2018

|

|||||

Account

|

Name

|

Description

|

Debit

|

Credit

|

|

41110001

|

Client: Company A

|

Sales Invoice N° 1

|

10,000.00

|

||

44200001

|

VAT on Sales: Company A

|

Sales Invoice N° 1

|

476.19

|

||

41110002

|

Client: Company B

|

Sales Invoice N° 2

|

5,000.00

|

||

44200002

|

VAT on Sales: Company B

|

Sales Invoice N° 2

|

238.10

|

||

41110003

|

Client: Company C

|

Sales Invoice N° 3

|

3,000.00

|

||

44200003

|

VAT on Sales: Company C

|

Sales Invoice N° 3

|

142.86

|

||

41110004

|

Client: Company D

|

Sales Invoice N° 4

|

2,000.00

|

||

44200004

|

VAT on Sales: Company D

|

Sales Invoice N° 4

|

95.24

|

||

41110005

|

Client: Company E

|

Sales Invoice N° 5

|

6,000.00

|

||

44200005

|

VAT on Sales: Company F

|

Sales Invoice N° 5

|

285.71

|

||

41110006

|

Client: Company G

|

Sales Invoice N° 6

|

8,000.00

|

||

44200006

|

VAT on Sales: Company G

|

Sales Invoice N° 6

|

380.95

|

||

41110007

|

Client: Company H

|

Sales Invoice N° 7

|

7,000.00

|

||

44200007

|

VAT on Sales: Company H

|

Sales Invoice N° 7

|

333.33

|

||

41110008

|

Client: Company I

|

Sales Invoice N° 8

|

6,000.00

|

||

44200008

|

VAT on Sales: Company I

|

Sales Invoice N° 8

|

285.71

|

||

41110009

|

Client: Company J

|

Sales Invoice N° 9

|

8,000.00

|

||

44200009

|

VAT on Sales: Company J

|

Sales Invoice N° 9

|

380.95

|

||

41110010

|

Client K – India

|

Sales Invoice N° 10

|

9,000.00

|

||

70010001

|

Sales under VAT

|

Total Sales for the day

|

52,380.95

|

||

70100001

|

Sales – Export

|

Total Sales for the day

|

9,000.00

|

||

64,000.00

|

64,000.00

|

||||

You will notice in this example that we did include

a sales figure falling under (export) and how usually it should be processed.

General

Expense Entry Specimen

|

||||||

Date: 02-01-2018

|

||||||

Account

|

Name

|

Description

|

Debit

|

Credit

|

||

63050001

|

Stationary

|

Office Square Inv#350

|

1,750.00

|

|||

44120001

|

VAT on expenses/ Office Square

|

Office Square Inv#350

|

87.50

|

|||

46100001

|

Other suppliers – Office Square

|

Total Sales for the day

|

1,837.50

|

|||

1,837.50

|

1,837.50

|

|||||

Purchase

Entry Specimen

|

||||

Date: 02-01-2018

|

||||

Account

|

Name

|

Description

|

Debit

|

Credit

|

60010001

|

Cost of Supplies

|

Purchase of goods Company Z Inv# 420

|

40,000.00

|

|

44120001

|

VAT on Purchases/ Company Z

|

Purchase of goods Company Z Inv# 420

|

2,000.00

|

|

40010001

|

Current Account Company Z

|

Purchase of goods Company Z Inv# 420

|

42,000.00

|

|

60010001

|

Cost of Supplies

|

Purchase of goods Company R Inv# 5007

|

7,000.00

|

|

44120002

|

VAT on Purchases/ Company R

|

Purchase of goods Company R Inv# 5007

|

350.00

|

|

40010002

|

Current Account Company R

|

Purchase of goods Company R Inv# 5007

|

7,350.00

|

|

49,350.00

|

49,350.00

|

|||

A couple

of comments on the Purchase entry:

There

are 2 invoices for supplies from 2 different suppliers.

We

used 2 separate auxiliaries for the VAT under one master account.

Upon

filing the tax returns, the accountant must cross check the total amount

purchased (40,000+7000) =47,000 and multiply it by 5% to get the exact amount

of Input VAT which should be in our example 2,350/- and equals to the sum up of

the master account of 4412 (2,000+350).

By

using this system, the company can easily calculate the input tax, and at the

same time, in the case the authorities requested to know the exact amount of

VAT levied on us by Company Z for example, auxiliary account 44120001 will show

the amount without complications or multiple cross-checking.

Have

all your suppliers and clients VAT numbers registered on in the operating

system?

Invoicing

- All outgoing invoices should hold the company VAT registration number.

- The

Invoice should show the official client name as per his Trade License / or

VAT registration.

- It

should show the client complete address and phone number, the same goes to

the Export.

- VAT

calculation should be on an item basis and not on a full invoice basis,

the problem will arise in the case the company is selling items exempt

from tax.

- The

VAT showing on the invoice should be in UAE Dirhams as per article 69 of

the Decree-law 8, even if the issued invoice bears another currency. the

conversion rate to be applied is the one published by the central bank.

- Invoice: VAT is calculated on a

line basis and not on an invoice level, since some of the items sold in

the said invoice may be exempt from tax. The above example shows a

straightforward error due to VAT miscalculation.

- VAT process should be well clear

at the invoicing level to put controls and determine who/what is taxable

and what can be considered zero-rated or exempt.

- VAT declaration may be monthly or

quarterly (solely depends on local legislation).

- Corporations in the UAE are

expected to keep their VAT records for 5 years, whereas their Saudi

counterparts should keep it 10 years.

- The FTA is in a position to

request reports supporting the tax refund claims in detail, but exact

types of reports are not disclosed yet. As a precaution, companies should

keep a copy of their yearly accounting data, purchase and sales ledgers,

invoice copies (hard or soft), as well as the clients proof of export in

case products or services, are shipped overseas.

- If the Operating system cannot

provide the sales breakdown by Emirate, this operation should be

undertaken by the accounting software since we are assuming that the tax

authorities may be requiring the company to state in which Emirate the

income/service is made.

- One sequence is enough for all

invoices (VAT or no VAT), but the companies Operating System should be

able to easily index and reference these invoices.

- PROFORMA is not taxable but since

it is widely used, some kind of legislation should be in place before VAT

implementation.

- Taxable income is calculated on an

accrual basis, for example, if an agreement is made by 2017 covering 3

years period, it does not mean that it is not taxable. The authorities

will consider when the service is executed to apply tax and failing to

accurately report the income may result in the company being liable to

penalties due to tax evasion.

- Keep records of your suppliers and

client’s identities since the authority may check your records at any

given time.

- Keep a register of your client’s

proof of export when it applies.

- Zero Rated VAT applies to the

below categories:

- Exports of goods and services

to outside the GCC;

- International transportation,

and related supplies;

- Supplies of certain sea, air

and land means of transportation (such as aircrafts and ships);

- Certain investment grade

precious metals (e.g. gold, silver, of 99% purity);

- Newly constructed residential

properties, that are supplied for the first time within 3 years of their

construction;

- Supply of certain education

services, and supply of relevant goods and services;

- Supply of certain health care

services and the supply of relevant goods and services.

Bad Debt:

This

is by far the most unfair circumstance that may happen to a company. In such an

instance, a company invoices its client and pays the due output tax; while

client declares insolvency before settling his dues. The legislation states

that VAT registered businesses will be able to reduce their output tax

liability by the amount of VAT that relates to the bad debt which has been

written off by the VAT registered business. The legislation will include the

conditions and limitations concerning the use of this relief.

- Pro rata: An issue will arise if

the company is dealing with taxable supplies as well as exempt ones.

Output tax is relatively easy to work with if the systems are compliant to

VAT. The complication is in the company’s General Expense. Till date, all

companies are accounting those said expenses in one ledge. Companies

having such a case should seek the FTA’s advice in order not to fall into

any problem later on. Basically, what happened in other countries is that

they agree with the local authorities on a percentage base on which

General expenses will be divided on a pro-rata basis.

- Proof of export: If the entity is

engaged in exporting goods and services, it is crucial to keep records on

how the taxable item was shipped (for 5 years), otherwise the VAT

authorities may reconsider the sale as local transaction and accordingly

claim the related output tax.

- Debit & Credit Notes: Special

attention should be taken while issuing those notes as they will be under

scrutiny from the tax authorities. If Credit Notes are linked to a taxable

income, a company can reclaim the VAT calculated on the corresponding

proportion within a given timeframe while sufficient proof may be required

in case of inspection. Debit Notes may need to include VAT too, pending to

get the final legislation.

Transition between 2017

& 2018

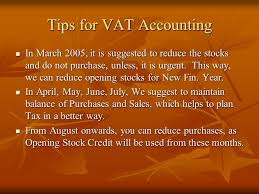

- The transition between 2017 and 2018 may prove to be the most challenging when it comes to VAT reporting. 2017 is the last year of having complete liberty on how to record your business transactions, even if it is not according to IAS or GAAP, while this should be immediately adjusted prior to stepping into 2018.

- The management should have a clear picture on how to deal with any business activity that is related to 2018, mainly the work in progress and cross year contracts. Even though the legislation is not yet very specific on such issues, common sense dictates that any business activity related to 2018 and beyond should be recorded in work in progress and not in 2017 income. Even if the invoice was issued for any given reason, the 2018 part should remain in WIP and not in the revenue ledgers.

- Companies should pay attention to

the overlapping agreements between 2017 and 2018. Most of the agreements

made during 2017 and earlier periods did not take the VAT into

consideration; hence, a special attention should be taken to allocating

the income/expense on the pro rata basis and calculating the VAT on the

2018 related amount.

- Invoicing the full contracts for

periods crossing 2018 and registering it as a 2017 income is, in fact, a

tax evasion that is punishable by law.

Nice post! This is very informative and knowledgeable article that's way I would like to say thanks for your efforts you have made in this post

ReplyDeleteCompany Liquidation in Dubai | Liquidation Services in the UAE

Thanks for sharing this useful content. If you are looking for an expert VAT Registration agency then get in touch with UAE Vat Registration of Professional Accountants and Consultants.

ReplyDeleteuae vat registration

vat registration uae

Great read. This blog provides essential insights for individuals and businesses looking to maintain accurate and compliant accounting practices in the UAE. vat accounting UAE

ReplyDelete